Wallbridge Exploration Drilling Continues to Deliver Significant Gold Grades from Dragonfly Zone Along Bug Lake Deformation Corridor

TORONTO, Sept. 29, 2025 (GLOBE NEWSWIRE) -- Wallbridge Mining Company Limited (TSX: WM, OTCQB:WLBMF) (“Wallbridge” or the “Company”) announced today the results for the first six holes from the second phase of drilling (“Phase 2”) at its 100% owned Martiniere gold project (“Martiniere”). These results further confirm the geologic continuity of the Dragonfly fault system as a series of sub-parallel mineralized structures, several of which host multiple high-grade gold intercepts ranging from 0.5 to over 5 metres in down-hole length.

HIGHLIGHTS*

| MR-25-128-W1 | 5.99 g/t Au over 4.7 m | including 42.70 g/t Au over 0.5 m | |

| MR-25-129B | 6.13 g/t Au over 3.4 m | ||

| 13.24 g/t Au over 2.0 m | |||

| MR-25-130A | 4.30 g/t Au over 3.6 m | including 11.30 g/t Au over 0.5 m | |

| 11.12 g/t Au over 2.0 m | including 19.70 g/t Au over 1.0 m | ||

| 2.57 g/t Au over 3.3 m | including 7.66 g/t Au over 0.6 m | ||

| MR-25-131 | 6.79 g/t Au over 1.0 m | ||

| 14.58 g/t Au over 3.3 m | including 45.40 g/t Au over 0.9 m | ||

| * True widths are estimated to be 60-90% of the reported core length intervals. | |||

“These latest drilling results continue to demonstrate the potential for a more extensive mineralized gold system at Martiniere than is currently outlined in the existing mineral resource estimate,” commented Brian W. Penny, CEO. “Phase 2 drilling, building on the success of Phase 1 completed in May, has been strategically focused on testing down-dip extensions of known gold zones. Current exploration is concentrated on the Dragonfly and Horsefly areas, where results to date suggest significant potential to expand the mineralized footprint and support future resource growth at Martiniere,” continued Mr. Penny.

Martiniere 2025 Drilling Program

The second phase of the 2025 Martiniere diamond drilling program began in mid-July (see Wallbridge news release dated July 17, 2025). This release reports results from the first six Phase 2 holes. Including Phase 1 drilling results (see June 2, 2025 and July 2, 2025 news releases) and the results presented in this news release, the Company has completed 22 holes and 2 hole extensions totaling 10,840 metres. Encouraged by continued positive results along the Bug Lake corridor, the Company has expanded the program beyond its original 10,000–15,000 metre plan, with drilling scheduled to continue into mid-October before winter demobilization.

Five of the Phase 2 holes reported here tested a 400-metre westerly strike projection of the Dragonfly zone toward the Bug Lake North and Horsefly zones. Drilling was completed along three north–south section lines spaced 150 metres apart, with hole depths extending to approximately 600 to 850 metres below surface. These holes were drilled to follow on strong results from Phase 1 holes MR-25-111, MR-25-112, MR-25-121, and MR-25-123. A table of summarized gold assay intervals and links to supporting maps and cross-sections are provided below.

- MR-25-129B (Section B-B’), collared 250 metres east of the Bug Lake North underground resource and 150 metres down-dip of Phase 1 hole MR-25-121, intersected multiple mineralized structures with intercepts that included 6.13 g/t Au over 3.4 metres, 2.31 g/t Au over 5.5 metres and 13.24 g/t Au over 2.0 metres.

- MR-25-130A (Section C-C’), 150 metres east of Section B-B’ and 150 metres down-dip of Phase 1 hole MR-25-123, returned three discrete gold-bearing structures with intercepts of 4.30 g/t Au over 3.6 metres, 11.12 g/t Au over 2.0 metres and 2.57 g/t Au over 3.3 metres.

-

MR-25-128 and wedge MR-25-128W1, along with MR-25-131 (Section D-D’), tested a 250 metre down-dip projection of mineralization intercepted in Phase 1 hole MR-25-111. Results included multiple gold-bearing structures, highlighted by intercepts of 5.99 g/t Au over 4.7 metres and 14.58 g/t Au over 3.3 metres.

The sixth Phase 2 drill hole, MR-25-127, drilled to test a potential down-dip extension of gold mineralization along the Martiniere North zone, did not return significant gold grades above 1 g/t Au. However, the hole intersected three shear deformation zones characterized by moderate to strong silicification and pyritic sulfide mineralization over widths of 5 to 6 meters down-hole. These alteration and mineralization styles are the key structural controls known to host gold at Martiniere, and their presence in MR-25-127 may be used as prospective vectors for follow-up drilling in the future.

The Phase 2 drilling campaign at Martiniere remains ongoing at the time of this news release. Assay results are pending for an additional 10 holes totaling 4,850 meters, and the Company plans to drill another 4 to 5 holes to complete the program. By the end of Phase 2 in October, Wallbridge expects to have completed approximately 18,000 meters of drilling at Martiniere during 2025.

To date, exploration drilling along the Bug Lake deformation corridor has intercepted significant gold mineralization across an area measuring approximately 2,000 by 800 metres and to a vertical depth of 800 metres from surface. Mineralization along the BL corridor remains open in both directions along strike and down dip. Importantly, deeper intercepts from historic drilling — including 6.4 metres grading 4.32 g/t Au in BLD-16-01 and 1.0 metre grading 6.18 g/t Au in MDE-17-289 — demonstrate that the Martiniere system remains open at depth to at least 850 metres below surface. Gold mineralization at Martiniere is hosted within mafic volcanics and younger felsic porphyry dykes, occurring along discrete shear and breccia zones associated with pyritic silica flooding, quartz-carbonate veining, and silica-sericite alteration.

For more information, please refer to the links below for a drill hole location map representative long-section and cross sections, and assay summaries of complete drill holes,.

Martiniere Gold Project: 2025 Phase 2 Drill Hole Location Map Plan View

Martiniere Gold Project: 2025 Phase 2 Longitudinal Section A-A’

Martiniere Gold Project: 2025 Phase 2 Cross Section B-B’

Martiniere Gold Project: 2025 Phase 2 Cross Section C-C’

Martiniere Gold Project: 2025 Phase 2 Cross Section D-D’

Martiniere Gold Project: Phase 2 2025 Drill Assay Summary and Drill Hole Location Information

| Martiniere Project 2025 Phase 2 Drill Assay Highlights1 | ||||||||

| From3 | To3 | Length3, 4 | Au | |||||

| Drill Hole | VG*2 | (m) | (m) | (m) | (g/t) | |||

| MARTINIERE NORTH | ||||||||

| MR-25-127 | No Intervals > 1.00 g/t Au | |||||||

| DRAGONFLY | ||||||||

| MR-25-128 | 178.0 | 179.0 | 1.0 | 1.07 | ||||

|

MR-25-128 Wedge1 |

430.4 | 432.7 | 2.3 | 2.14 | ||||

| Including | 430.4 | 431.2 | 0.8 | 1.40 | ||||

| 431.2 | 432.7 | 1.5 | 2.54 | |||||

| * | 463.0 | 467.7 | 4.7 | 5.99 | ||||

| Including * | 463.0 | 463.5 | 0.5 | 3.74 | ||||

| 463.5 | 467.2 | 3.7 | 1.33 | |||||

| * | 467.2 | 467.7 | 0.5 | 42.70 | ||||

| 526.9 | 528.4 | 1.5 | 1.85 | |||||

| 545.5 | 546.5 | 1.0 | 1.53 | |||||

| 592.8 | 594.1 | 1.4 | 2.32 | |||||

| MR-25-129B | 328.7 | 332.0 | 3.4 | 6.13 | ||||

| Including | 328.7 | 329.4 | 0.8 | 9.99 | ||||

| 329.4 | 331.0 | 1.6 | 1.15 | |||||

| 331.0 | 332.0 | 1.0 | 11.20 | |||||

| 431.0 | 432.5 | 1.5 | 3.49 | |||||

| Including | 431.0 | 432.0 | 1.0 | 0.45 | ||||

| 432.0 | 432.5 | 0.5 | 9.57 | |||||

| 451.0 | 452.0 | 1.0 | 7.85 | |||||

| 481.0 | 482.5 | 1.5 | 2.54 | |||||

| Including | 481.0 | 482.0 | 1.0 | 0.55 | ||||

| 482.0 | 482.5 | 0.5 | 6.51 | |||||

| 495.0 | 496.5 | 1.5 | 13.60 | |||||

| 514.5 | 520.0 | 5.5 | 2.31 | |||||

| Including | 514.5 | 516.0 | 1.5 | 1.67 | ||||

| 516.0 | 520.0 | 4.0 | 2.55 | |||||

| 542.5 | 544.0 | 1.5 | 3.91 | |||||

| 550.5 | 552.0 | 1.5 | 3.16 | |||||

| 570.0 | 571.1 | 1.1 | 3.38 | |||||

| 604.0 | 606.0 | 2.0 | 13.24 | |||||

| Including | 604.0 | 605.0 | 1.0 | 19.30 | ||||

| 605.0 | 606.0 | 1.0 | 7.18 | |||||

| 666.8 | 668.0 | 1.2 | 1.38 | |||||

| 683.2 | 684.0 | 0.9 | 1.89 | |||||

| 690.0 | 692.0 | 2.0 | 1.24 | |||||

| MR-25-129B (cont’d) | 698.0 | 699.3 | 1.3 | 1.24 | ||||

| 708.0 | 709.0 | 1.0 | 2.52 | |||||

| 729.0 | 734.0 | 5.0 | 1.22 | |||||

| 747.8 | 750.0 | 2.2 | 1.73 | |||||

| MR-25-130A | 352.3 | 355.9 | 3.6 | 4.30 | ||||

| Including | 352.3 | 354.0 | 1.7 | 3.48 | ||||

| 354.0 | 354.5 | 0.5 | 11.30 | |||||

| 354.5 | 355.9 | 1.4 | 2.80 | |||||

| 482.0 | 484.0 | 2.0 | 11.12 | |||||

| Including | 482.0 | 483.0 | 1.0 | 2.54 | ||||

| 483.0 | 484.0 | 1.0 | 19.70 | |||||

| 521.8 | 525.1 | 3.3 | 2.57 | |||||

| Including | 521.8 | 522.4 | 0.6 | 7.66 | ||||

| 522.4 | 525.1 | 2.7 | 1.44 | |||||

| MR-25-131 | 247.7 | 250.2 | 2.5 | 1.04 | ||||

| 462.5 | 466.0 | 3.5 | 1.02 | |||||

| 476.0 | 477.0 | 1.0 | 6.79 | |||||

| 483.0 | 485.5 | 2.5 | 1.86 | |||||

| 491.0 | 492.0 | 1.0 | 1.05 | |||||

| 509.9 | 510.4 | 0.5 | 5.77 | |||||

| 513.0 | 513.5 | 0.5 | 4.61 | |||||

| 528.4 | 530.0 | 1.6 | 1.21 | |||||

| 532.8 | 535.0 | 2.3 | 2.81 | |||||

| 547.1 | 550.4 | 3.3 | 14.58 | |||||

| Including | 547.1 | 548.0 | 0.9 | 45.40 | ||||

| 548.0 | 549.8 | 1.8 | 2.12 | |||||

| 549.8 | 550.4 | 0.6 | 5.75 | |||||

| Notes | ||||||||

| 1 | Assay highlights have been selected based on a combination of criteria, including observable mineralization and/or having a Metal Factor >5 gm*m (MF = Au g/t * Interval length). | |||||||

| 2 | Asterisk * denotes visible gold (VG) observed in drill core. | |||||||

| 3 | Reported drill hole depths and interval lengths have been rounded to the nearest 0.1 metres. As a result, interval lengths may vary slightly from differences calculated directly from drill hole depths reported here. | |||||||

| 4 | True widths are estimated to be 60-90% of the reported core length intervals. | |||||||

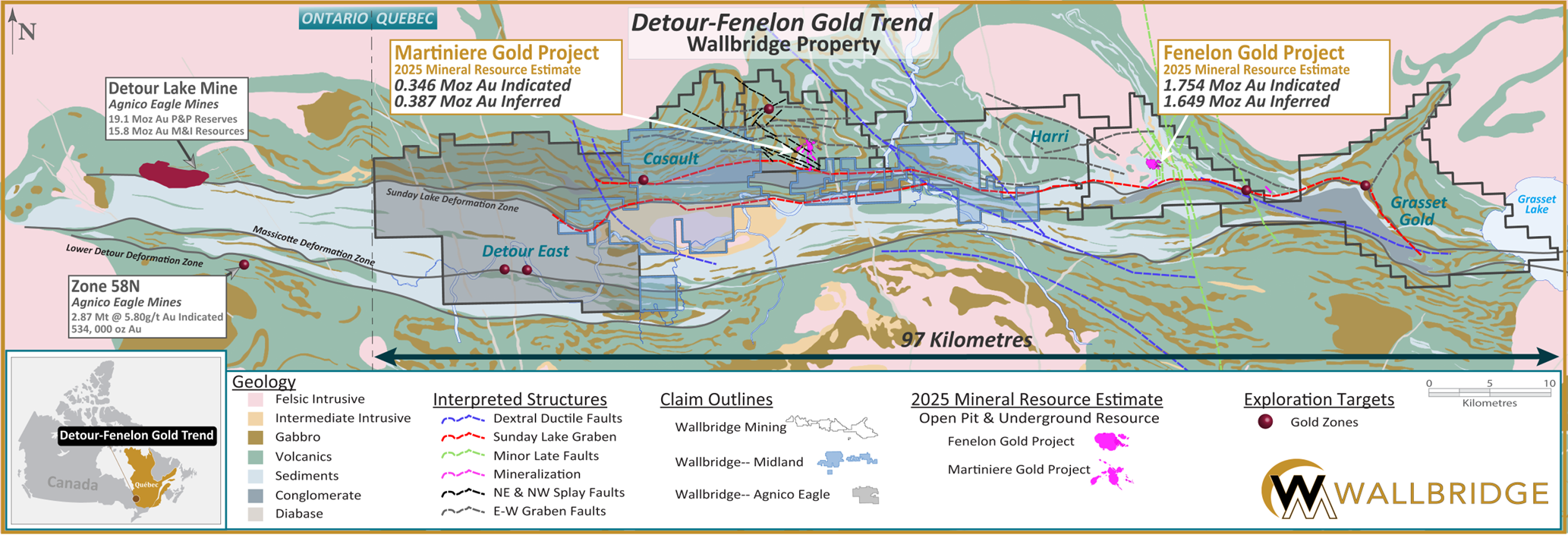

The Martiniere project is a key component of the Company’s 830 square kilometre Detour-Fenelon Trend property package. Martiniere is located in Northern Abitibi, Quebec, 30 kilometres west of the Company’s flagship Fenelon gold project and 50 kilometres east of Canada’s largest gold mine, Agnico Eagle’s Detour Lake gold mine.

Wallbridge Mining Detour – Fenelon Gold Trend Properties

Quality Assurance / Quality Control

Wallbridge maintains a Quality Assurance/Quality Control ("QA/QC") program for all its exploration projects using industry best practices. Key elements of the QA/QC program include verifiable chain of custody for samples, regular insertion of blanks and certified reference materials, and completion of secondary check analyses performed at a separate independent accredited laboratory. Drill core is halved, sampled, and shipped in sealed bags to Activation Laboratories Ltd. (ActLabs) in Val d’Or, Quebec, where samples are routinely analysed via fire assay with atomic absorption spectroscopy (‘AAS’) finish methods. For greater precision and accuracy, samples assaying 10 g/t Au or greater are re-distributed to other ActLabs facilities where they are re-assayed via metallic screen fire assay or fire assay/gravimetric finish, depending on the amount of sample material remaining available. Samples containing visible gold are routinely submitted directly for analysis by metallic screen fire assay method. Activation Laboratories Ltd. operates under a Quality Management System that conforms to the requirements of ISO/IEC 17025.

Qualified Person

The Qualified Person responsible for the technical content of this news release is Mr. Mark A. Petersen M.Sc., P.Geo. (OGQ AS-10796; PGO 3069), Senior Exploration Consultant for Wallbridge.

About Wallbridge Mining

Wallbridge is focused on creating value through the exploration and sustainable development of gold projects in Quebec’s Abitibi region while respecting the environment and communities where it operates. The Company holds a contiguous mineral property position totaling 830 km2 that extends approximately 97 km along the Detour-Fenelon gold trend. The property is host to the Company’s flagship PEA stage Fenelon Gold Project, and its earlier exploration stage Martiniere Gold Project, as well as numerous other gold exploration targets.

For further information please visit the Company’s website at https://wallbridgemining.com/ or contact:

Wallbridge Mining Company Limited

| Brian Penny, CPA, CMA Chief Executive Officer Email: bpenny@wallbridgemining.com M: +1 416 716 8346 |

Tania Barreto, CPIR Director, Investor Relations Email: tbarreto@wallbridgemining.com M: +1 416 289 3012 |

Cautionary Note Regarding Forward-Looking Information

The information in this document may contain forward-looking statements or information (collectively, “FLI”) within the meaning of applicable Canadian securities legislation. FLI is based on expectations, estimates, projections and interpretations as at the date of this document.

All statements, other than statements of historical fact, included herein are FLI that involve various risks, assumptions, estimates and uncertainties. Generally, FLI can be identified by the use of statements that include, but are not limited to, words such as “seeks”, “believes”, “anticipates”, “plans”, “continues”, “budget”, “scheduled”, “estimates”, “expects”, “forecasts”, “intends”, “projects”, “predicts”, “proposes”, "potential", “targets” and variations of such words and phrases, or by statements that certain actions, events or results “may”, “will”, “could”, “would”, “should” or “might”, “be taken”, “occur” or “be achieved.”

FLI in this document may include, but is not limited to: statements regarding current and future exploration and drilling results; the results of the preliminary economic assessment (“PEA”); the Company’s ability to convert inferred resources into measured and indicated resources; environmental matters; stakeholder engagement and relationships; parameters and methods used to estimate the mineral resource estimates (“MREs") at Fenelon and Martiniere (collectively the “Deposits”); the prospects, if any, of the Deposits;; and the significance of historic exploration activities and results.

FLI is designed to help you understand management’s current views of its near- and longer-term prospects, and it may not be appropriate for other purposes. FLI by their nature are based on assumptions and involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance, or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such FLI. Although the FLI contained in this document is based upon what management believes, or believed at the time, to be reasonable assumptions, the Company cannot assure shareholders and prospective purchasers of securities of the Company that actual results will be consistent with such FLI, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither the Company nor any other person assumes responsibility for the accuracy and completeness of any such FLI. Except as required by law, the Company does not undertake, and assumes no obligation, to update or revise any such FLI contained in this document to reflect new events or circumstances. Unless otherwise noted, this document has been prepared based on information available as of the date of this document. Accordingly, you should not place undue reliance on the FLI, or information contained herein.

Furthermore, should one or more of the risks, uncertainties or other factors materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in FLI.

Assumptions upon which FLI is based, without limitation, include: the results of exploration activities, the Company’s financial position and general economic conditions; the ability of exploration activities to accurately predict mineralization; the accuracy of geological modelling; the ability of the Company to complete further exploration activities; the legitimacy of title and property interests in the Deposits; the accuracy of key assumptions, parameters or methods used to estimate the MREs and in the PEA; the ability of the Company to obtain required approvals; geological, mining and exploration technical problems; failure of equipment or processes to operate as anticipated; the evolution of the global economic climate; metal prices; foreign exchange rates; environmental expectations; community and non-governmental actions; and, the Company’s ability to secure required funding. Risks and uncertainties about Wallbridge's business are discussed in the disclosure materials filed with the securities regulatory authorities in Canada, which are available at www.sedarplus.ca.

Cautionary Notes to United States Investors

Wallbridge prepares its disclosure in accordance with NI 43-101 which differs from the requirements of the U.S. Securities and Exchange Commission (the "SEC"). Terms relating to mineral properties, mineralization and estimates of mineral reserves and mineral resources and economic studies used herein are defined in accordance with NI 43-101 under the guidelines set out in CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the Canadian Institute of Mining, Metallurgy and Petroleum Council on May 19, 2014, as amended. NI 43-101 differs significantly from the disclosure requirements of the SEC generally applicable to US companies. As such, the information presented herein concerning mineral properties, mineralization and estimates of mineral reserves and mineral resources may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the U.S. federal securities laws and the rules and regulations thereunder.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/ee2053b8-4d87-4d03-a467-61dfe7cf1be0

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.